First Quarter 2021 Review

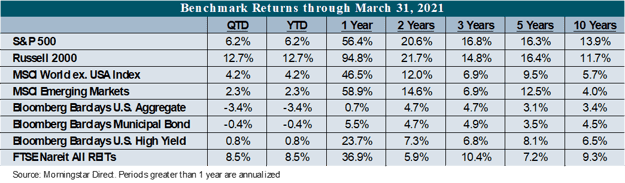

Capital markets provided mixed returns during the first quarter as value-style indices advanced, growth-style indices lagged and fixed income markets declined. A confluence of factors is creating both tailwinds and headwinds in the markets: Approved stimulus measures and proposed infrastructure spending combined with expanding COVID-19 vaccine deployments and easing mobility restrictions are expected to drive corporate earnings growth into the double-digits this year. Conversely, the associated risk of higher inflation and interest rates are pressuring growth-style equity valuations and bond prices. For the first time in years, quarterly performance for the Russell 1000 Value Index has outperformed both the S&P 500 and the Russell 1000 Growth Index by approximately 5.1% and 10.3%, respectively. Fixed income, which benefited last year from declining interest rates, generated a return of -3.4% as rising inflation and interest rate expectations pressured bond prices.

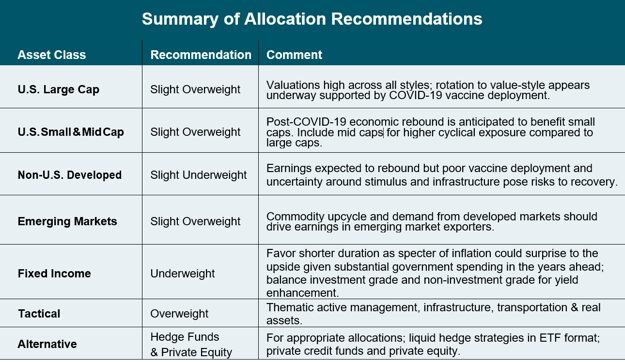

We have repositioned portfolios towards a more value-centric approach across equity allocations, including adding tactical positions that we believe may perform well as the U.S. initiates massive infrastructure spending. We are modestly underweight fixed income and continue to gravitate towards shorter duration bond strategies that are less impacted by inflation concerns and rising rates, while maintaining the safe-haven characteristics associated with the asset class. While the risks of 2020 are slowly fading, new and different risks (and opportunities) are presenting.

The Big Picture

U.S. real gross domestic product (GDP) grew at approximately 4.3% in the fourth quarter and is expected to increase by over 6.5% in 2021. The tremendous projected growth is well in excess of that achieved in recent memory and is largely attributed to increasing vaccine deployments, the reopening of the economy and the lifting of mobility restrictions across the country. Importantly, the Biden administration will do its part with the recent enactment of the American Rescue Plan Act, which provides $1.9 trillion for the economy, including $1,400 stimulus payments to those who qualify. On March 31st, the Biden administration announced its intention for an infrastructure spending plan of nearly $3.0 trillion that will focus on issues such as renewable energy, bridges, roads, the electric grid and others. Markets have anticipated such a development since the election, which has resulted in higher prices for commodities and share prices of companies that will be required to deliver on such a bold plan. The U.S. is not alone in its intentions to modernize its infrastructure, as both China and the European Union are developing their respective infrastructure plans. China has for years focused on its One Belt/One Road initiative, connecting trading locations throughout Asia, North Africa and the European Union. The European Union (EU) is looking to develop its own infrastructure plan, but first must have agreement across the 27 EU member nations in order to access capital markets.

The massive amount of stimulus and infrastructure spending will drive U.S. deficits to record levels, while the Federal Reserve assures markets of its intent to maintain low interest rates. The market has interpreted these actions as a significant driver of inflation, which has pushed expected levels of inflation (the difference between nominal Treasury bonds and Treasury Inflation Protected bonds) to about 2.5%, or about 1.1% above the most recent reported level of realized inflation. As inflation expectations increased, the U.S. benchmark 10-Year Treasury bond sold-off, pushing its yield to 1.75% and negatively impacting most securities that have respective prices that are tied directly or indirectly to the benchmark rate.

The Outlook

We remain overweight to U.S. large cap equities, with a bias toward value-style investments. Analyst expectations project value-style investments, such as the Russell 1000 Value Index, to increase 2021 earnings by approximately 17% or about 300 basis points higher than growth-style securities represented by the Russell 1000 Growth Index. Equity valuations remain high and value-style valuations pose less relative risk as their forward price-to-earnings ratio (P/E) is about 33% lower than that of the growth index. Consequently, we have repositioned client portfolios to be more value-centric relative to growth.

Within U.S. small and mid (SMID) cap markets, we improved our allocation to overweight as the asset class is expected to correlate well with a resurging U.S. economy. Earnings during the last quarter of 2020 have already rebounded to pre-COVID levels, despite much of the U.S. still under COVID-restrictions during that time. As reopening plans are being pulled forward due to widespread vaccine rollouts, we anticipate the growth in earnings to be pulled forward as well. We are emphasizing passive versus active management within SMID caps as we believe these dynamics represent a “rising tide” and the most efficient and cost-effective exposure to the asset class is through passive index exposure. Passive indices within small caps also offer less concentration and more diversified exposure compared to large caps, resulting in more exposure to cyclical areas of the economy like financials and industrials.

We remain underweight within non-U.S. developed markets, primarily due to the limited success of COVID-19 vaccine deployments, rising Covid infection rates, and mobility restrictions that have continued to limit the economic recovery compared to the rest of the world. In our view, these risks are likely to produce headwinds that will diminish the benefits developed markets should receive from a rotation back into value-oriented industries. Furthermore, while countries such as the U.S. and China implement stimulus measures to invigorate economic growth, Europe’s requirement to attain unanimous EU member agreement on spending programs creates delayed economic resurgence.

We improved our allocation to emerging markets to overweight. First, emerging markets have recovered from the COVID-19 pandemic relatively better than non-US developed markets. Second, as the U.S. economy recovers and infrastructure plans are implemented, the demand for commodities from resource-rich emerging markets will boost earnings in emerging markets. Additionally, emerging markets are a manufacturing hub for the U.S. and given the current constraints in supply lines and low inventory levels in the U.S., surging demand from consumers will likely benefit emerging market companies over the coming years. In result, corporate earnings in emerging markets are projected to grow 37% in 2021, with the highest expected contributions coming from cyclical sectors such as financials, industrials, materials, and energy.

We reduce our fixed income allocation to underweight. Our view is informed by above-average anticipated growth within the U.S. economy, which increases the risk of rising inflation and interest rates. With the short-end of the curve anchored to zero by the Federal Reserve, rising rates are mostly likely to result in a steepening of the yield curve. Longer-term duration bonds are expected to perform poorly in this scenario relative to short-term bonds as rising rates discount future bonds flows more severely. As a consequence, we remain focused on short duration bonds within client portfolios to preserve the safe haven characteristics of fixed income and to alleviate the negative implications of rising inflation and interest rates.

Tax and Financial Planning News

While higher expected inflation may continue to impact your portfolio, it may also impact your personal balance sheet and estate planning opportunities. Ascending from historic lows in 2020, mortgage rates have started creeping higher in 2021. If you currently have an Adjustable Rate Mortgage (ARM) or a Home Equity Line of Credit (HELOC), this may be an opportunity to lock in a fixed longer term rate. Additionally, consider expediting purchases of durable goods or vehicles where appropriate to capitalize on more attractive terms and lower prices today.

On the estate planning side, higher inflation and interest rates will affect planning strategies such as intra-family loans, which are based on the monthly Applicable Federal Rate (AFR) published by the Treasury department. A rising AFR will also negatively affect estate planning strategies including Grantor Retained Annuity Trusts, installment sales, and charitable planning trusts such as Charitable Lead trusts. Tax policy is on the top of President Biden’s agenda. Anticipating the change and how it may effect you and your family is critical. Please reach out to a Round Table Wealth Advisor for a review of your personal circumstances.

*The content herein is provided to you by unaffiliated sources believed to be reliable, but not guaranteed on an as-is basis without any warranties of any kind. In no event shall Owner Resource Group, LLC be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever with respect to this content. The content is distributed for informational purposes only and not intended to provide investment advice. The information contained in this article is accurate as of the data submitted, but is subject to change. We strongly recommend you consult your professional business advisors before making any financial or investment decisions.